Partner:Northern Powerhouse Investment Fund

Region:Sheffield City Region

Location:Sheffield

Programme:Northern Powerhouse Investment Fund

The Company

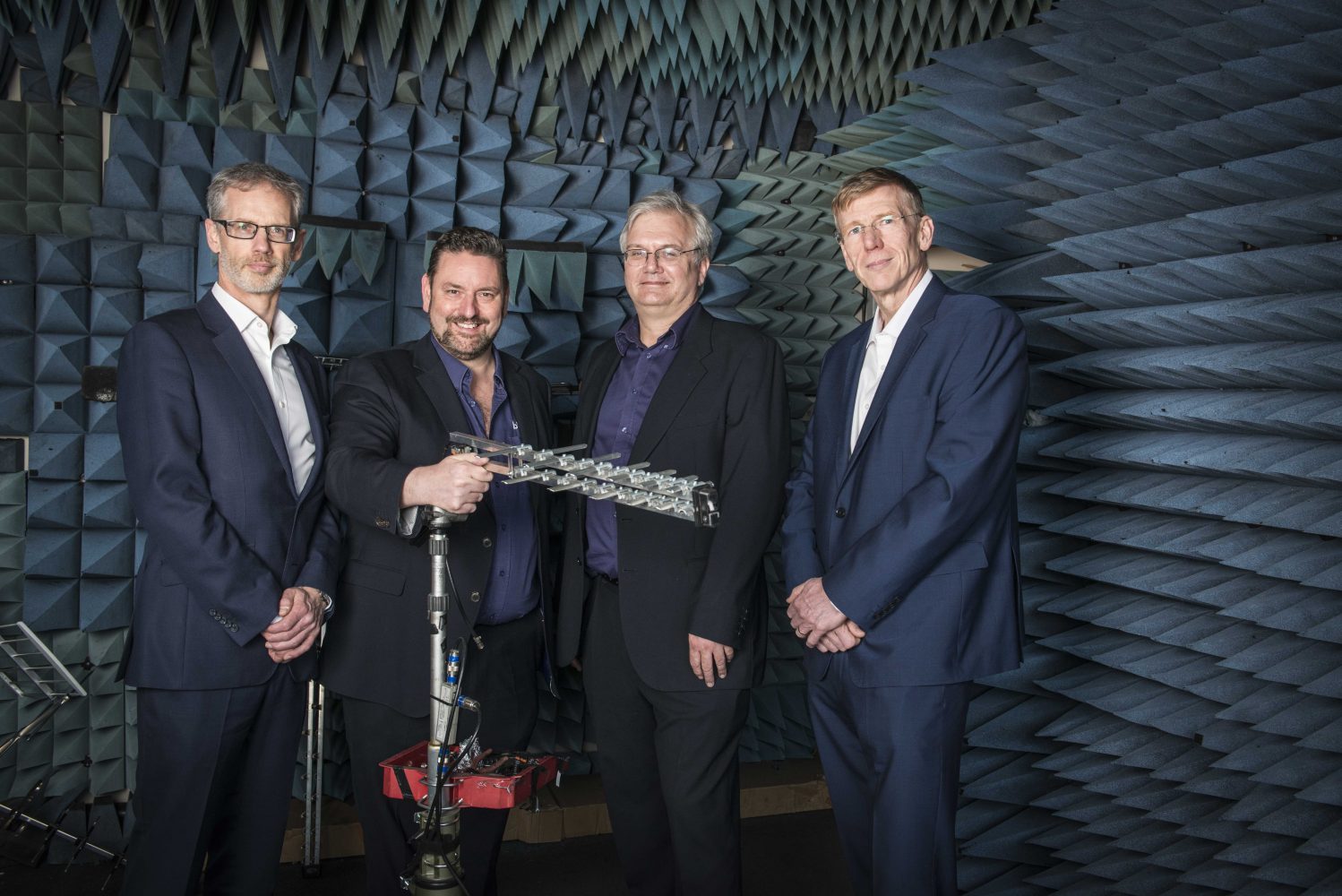

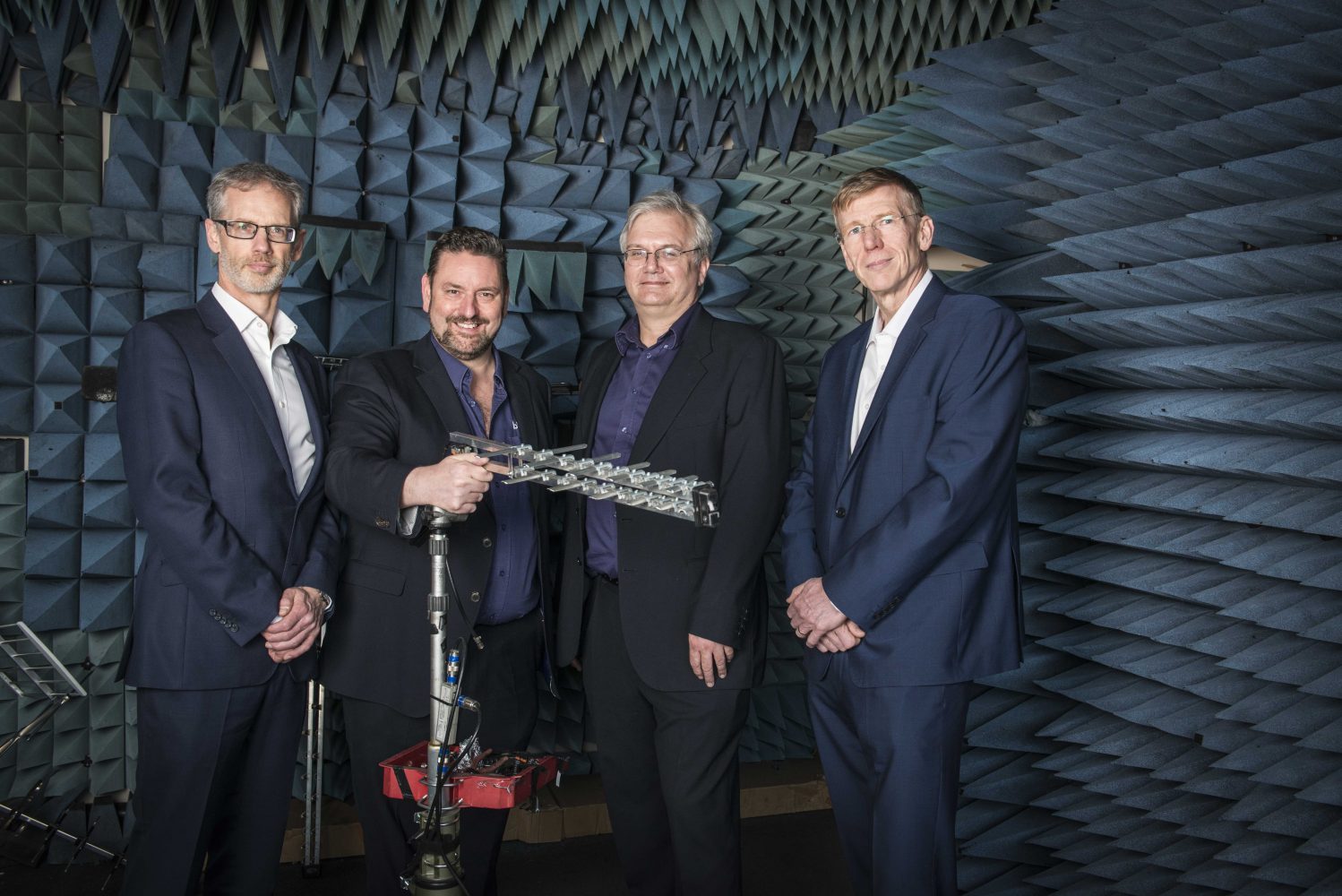

Established in 1971, Blake UK has grown to become one of the largest manufacturers and suppliers in the TV/AV sector. Formed primarily as a manufacturer of TV aerials for supply to the local area it has grown to be a manufacturer and importer of aerials, electronics and components for all radio frequency applications as well as maintaining its core business of supplying the TV aerial market. The company, which operates from its 40,000 sq. ft site in Sheffield, employs 24 staff and reported turnover of £2.2m in the year to March 2016.

The Deal

The company which has a proven track record of working with finance providers to capitalise on growth secured a £100,000 loan to fund new product development and invest in new equipment from NPIF – Enterprise Ventures Debt Finance, an NPIF fund managed by Enterprise Ventures.

Enterprise Venture’s Investment Rationale

The funding will allow the company to diversify its product range into new lines such as CCTV equipment. Blake UK will also use the investment to strengthen its stock level to reflect the long stock replenishment lead times that accompanies existing ranges. This means the company will be able to keep up with the demands from its growing customer base and ensure that the quality and diversity of its product offering remains high.

Paul Blake, Managing Director at Blake UK, said: “The support from NPIF – Enterprise Ventures Debt Finance was quick, straightforward, and provides a solid platform from which we can expand and achieve our growth ambitions for the future. These funds will allow us to increase our product range and bolster stock to meet strong customer demand for our products. We have been delighted with the level of support from Enterprise Ventures and are confident that we can now take our business to the next level.”

Pete Sorsby, Investment Manager at NPIF – Enterprise Ventures Debt Finance, added: “Blake is a forward thinking business and the management team has done a brilliant job of keeping up with the latest technological developments in the market. The company manufactures a number of its own-brand products and it is the quality of these products that really sets it apart from other competitors. We have known Paul and the team for a number of years and are pleased to be supporting the business as it continues to grow.”

The Northern Powerhouse Investment Fund project is supported financially by the European Union using funding from the European Regional Development Fund (ERDF) as part of the European Structural and Investment Funds Growth Programme 2014-2020 and the European Investment Bank.

For more information about Northern Powerhouse Investment Fund, please visit www.npif.co.uk.

Enterprise Ventures Limited is authorised and regulated by the Financial Conduct Authority (FRN: 183363)

EV Business Loans Limited is authorised and regulated by the Financial Conduct Authority (FRN: 443560)

If you would like to meet with one of NPIF's appointed Fund Managers to talk in more detail please go to Funds Available to find the Fund Managers operating in your area