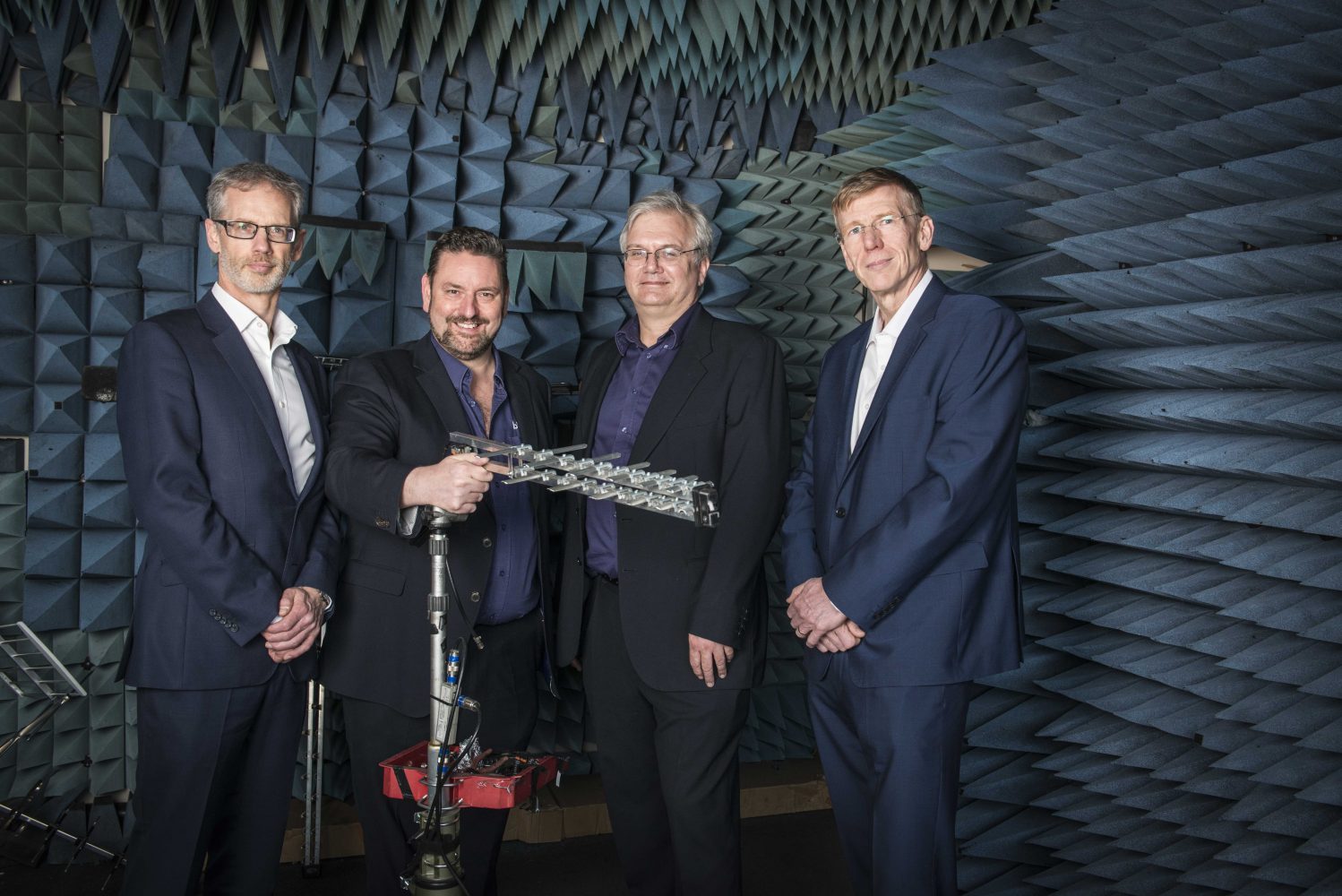

Image caption: The Northern Powerhouse Investment Fund has recently set up a new £400m fund for small businesses in the north of England and one of its first investments will be in Blake UK. Blake is a family run business that has grown to become one of the largest manufacturers and suppliers to the UK’s television aerial industries. Pete Sorsby (Investment manager Enterprise Ventures), Paul Blake (MD Blake UK), Cavin Carver (Operations Director Blake UK) and Ken Cooper (MD NPIF) in the testing room at Blake UK

11th April 2017

Tags

The £400m Northern Powerhouse Investment Fund (NPIF) has announced the first investments following its launch in February, with more than £240,000 going to four SMEs.

The transactions, which are spread across the Northern Powerhouse region, include:

Blake UK

NPIF – Enterprise Ventures Debt Finance, provided a £100,000 loan to Sheffield-based TV/AV reception and distribution products manufacturer/importer and supplier Blake UK. The funding will allow the company to diversify its product range into new lines such as CCTV equipment and increase stock levels required for new product ranges.

Red Security Solutions

Business Finance Solutions has invested £100,000 in Greater Manchester based mobile CCTV solutions provider Red Security Solutions Limited (RSS). The money, sourced from NPIF – BFS & AFM Microfinance, will allow RSS to invest into a range of new hybrid and solar powered security solutions.

Vulcan Passive Fire Systems

NPIF – BEF & FFE Microfinance, provided £40,000 to Leeds based fire protection company Vulcan Passive Fire Systems. The company produces a range of fire protection products and systems. The money is part of a package which has allowed Vulcan Passive Fire Systems to employ four staff, with vehicles and accompanying equipment.

AEV

NPIF – FW Capital Debt Finance, supported Birkenhead-based AEV Limited, a manufacturer of varnishes, resins, compounds and insulating products designed for the electrical and electronic sectors. The funding will support the company’s continuing growth strategy, particularly in emerging markets outside the European Union.

Operating from the British Business Bank’s Sheffield head office, the Northern Powerhouse Investment Fund provides capital to fund managers who will offer Microfinance (£25,000 – £100,000), Business Finance (£100,000 – £750,000) and Equity Finance (up to £2m). NPIF works alongside 10 Local Enterprise Partnerships (LEPs), bringing together unprecedented partnerships with LEPs on both sides of the Pennines.

NPIF also works with combined authorities and Growth Hubs, as well as with local accountants, fund managers and banks, to provide a mixture of debt and equity capital to Northern-based SMEs at all stages of their development.

Northern Powerhouse Minister Andrew Percy said: “Our efforts to build the Northern Powerhouse are delivering real results for local people. More than one million businesses are already involved and foreign direct investments are up by a quarter.

“This dedicated £400m fund will help us go even further. As part of our Plan for Britain to create a stronger economy, it will help smaller businesses across the region.

“These first investments show how this fund is already making a great impact. It’s delivering the resources local businesses need to reach their potential.”

Keith Morgan, CEO at British Business Bank, said: “While there is work ahead to fully unlock the potential of businesses across the Northern Powerhouse region, the announcement of these first investments shows significant momentum and is cause for great optimism. We are confident that we can build on this strong start to provide funding across the range of geographies and sectors, making a real difference to the Northern Powerhouse region.”

Paul Blake, Managing Director at Blake UK, said: “The support on offer from NPIF -Enterprise Ventures Debt Finance was quick, straightforward, and provides a solid platform from which we can expand and achieve our growth ambitions for the future. These funds will allow us to increase our product range and bolster stock to meet strong customer demand for our products, and we are delighted that with the support from Enterprise Ventures we can take our business to the next level.”

The Northern Powerhouse Investment Fund project is supported financially by the European Union using funding from the European Regional Development Fund (ERDF) as part of the European Structural and Investment Funds Growth Programme 2014-2020 and the European Investment Bank.

For more information about Northern Powerhouse Investment Fund, please visit www.npif.co.uk.

Photo Caption:

(L-R) Pete Sorsby (Investment Manager, Enterprise Ventures), Paul Blake (Managing Director, Blake UK), Cavin Carver (Operations Director, Blake UK) and Ken Cooper (MD, Venture Solutions, British Business Bank) in the testing room at Blake UK.

If you would like to meet with one of our appointed Fund Managers to talk in more detail please go to 'Funds Available' to find the Fund Managers operating in your area

Just add your details below to receive the latest Northern Powerhouse Investment Fund news and information