Partner:Maven

Region:North West

Location:Macclesfield

Programme:Northern Powerhouse Investment Fund

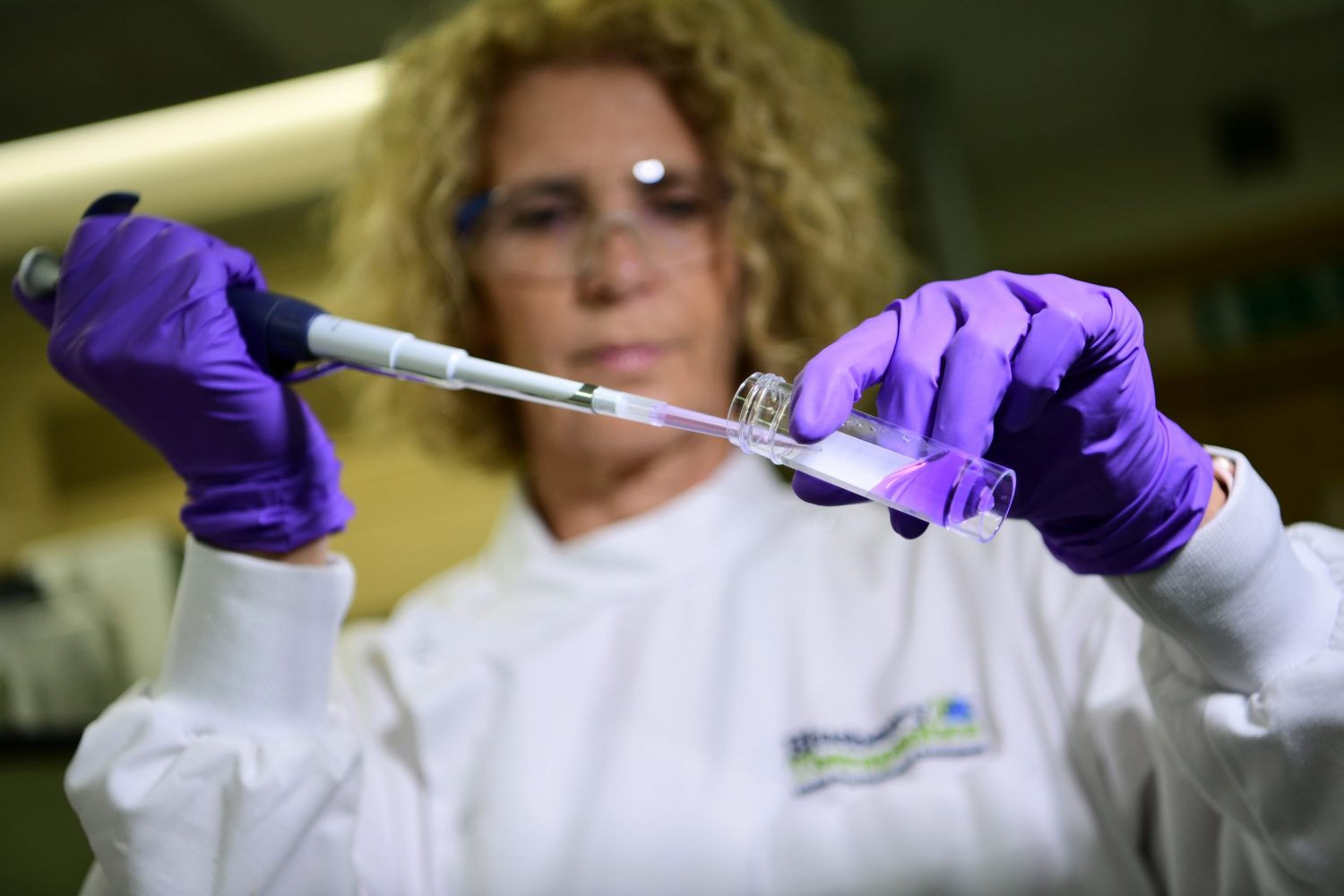

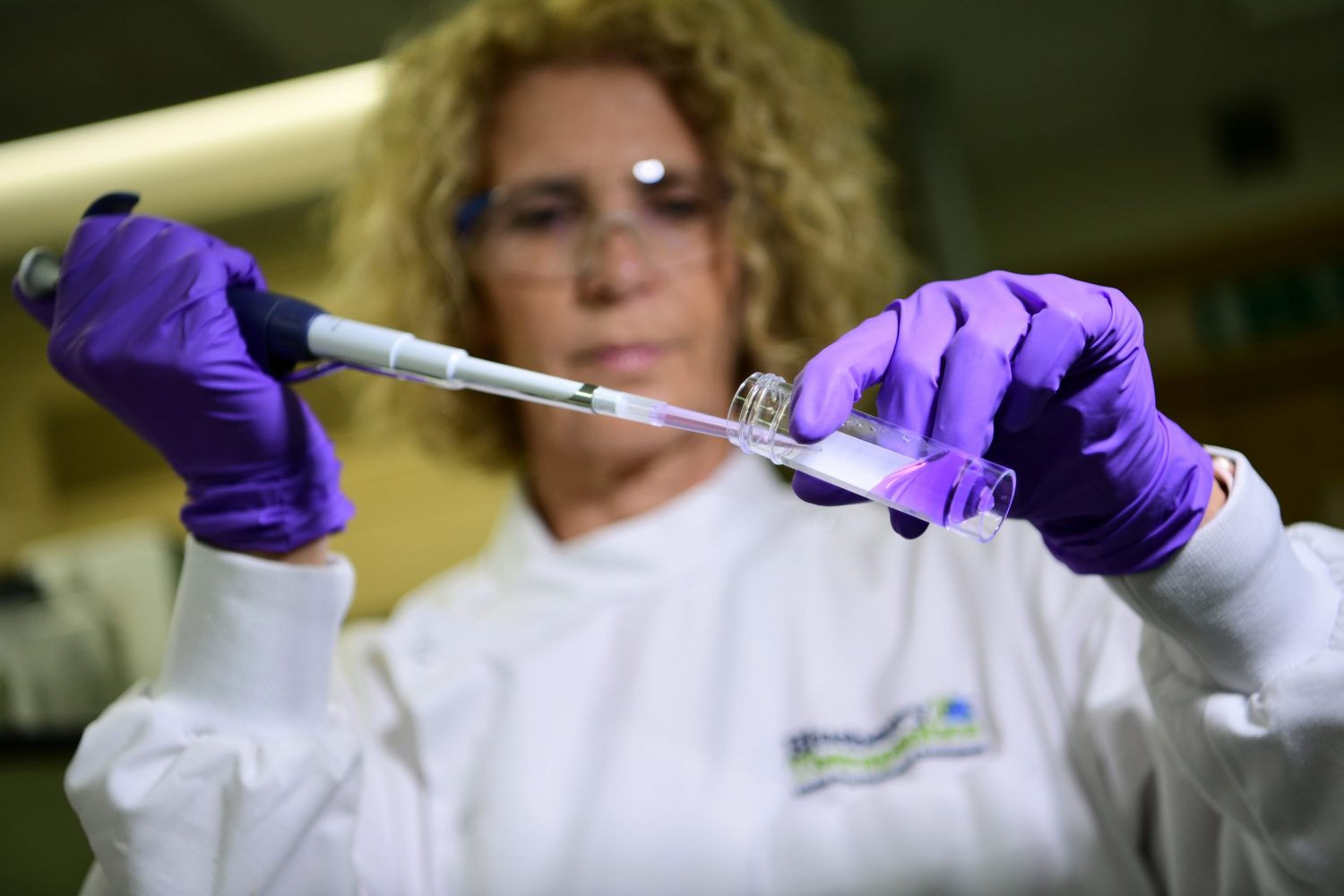

NPIF – Maven Equity Finance, managed by Maven Capital Partners and part of the Northern Powerhouse Investment Fund invested £750,000 in Blueberry Therapeutics Limited (“Blueberry”), a drug discovery and development company focused on developing innovative nanomedicines for difficult to treat skin and nail infections.

The funding will support the business as it embarks on the next set of clinical trials for a new topical antifungal spray for the treatment of onychomycosis using its unique nanodelivery platform technology, as well as progressing other product development lines.

Based at Alderley Park, Macclesfield, Blueberry focuses on developing innovative nanomedicines for difficult to treat skin and nail infections such as onychomycosis, athlete’s foot, atopic dermatitis, topical analgesia and acne. Blueberry’s nanomedicines enable enhanced drug delivery into skin and nail for better patient outcomes, with differentiation from current products by matching or improving upon existing drug efficacy at significantly reduced doses. This also translates to improved patient safety and drug tolerability, increased compliance, and reduced cost of goods.

Existing treatments for nail infection are only mildly effective and come with significant safety and tolerability issues. Blueberry’s aim is to apply the spray directly to the nail, and through enhanced delivery of the active substance through the nail, to match the cure rates of the more effective oral formulations in a topical medicine, without the associated safety concerns.

The market for treatment of nail and skin infections is currently $3bn and is expected to grow significantly to c.$4bn. Whilst the clinical need for this treatment is largely unmet with an estimated 200 million patients going untreated, with increased access to safe and efficacious topical treatments, the market opportunity is extremely large.

Led by a strong management team, CEO, John Ridden, is an experienced leader with over 20 years experience in small and large pharma. Prior to founding Blueberry in 2011, he held Leadership roles both at Pfizer and AstraZeneca where he both led and supported a number of drug discovery projects.

The deal was led by Senior Investment Managers, Alex Rothwell and Gavin Bell, at Maven’s Manchester office. Gavin said, “The life sciences and biotech sector seems to be thriving more than ever at the moment in the Northern Powerhouse region, with a growing ecosystem of really promising, innovative companies. Blueberry is a great example of this, focused on the dermatology space. We’re delighted to invest in John and this high-quality team and board, to help support the development and commercialization of its product portfolio.

John Ridden CEO, Blueberry, said: “We are very happy to have Maven as part of the Blueberry team as we now enter an important phase of our company development. We are delighted to have enrolled our first group of patients into our Phase IIb clinical trial for onychomycosis and excited to see just how well our drug performs in this common and unpleasant disease”

Sue Barnard from British Business Bank, said: “Blueberry Therapeutics is another forward-thinking NPIF-backed business operating out of Alderley Park – one of a number of hubs for scientific excellence in the North. This investment demonstrates how NPIF funding can make a real and measurable difference to businesses across the Northern Powerhouse region, which in turn helps create a more prosperous regional economy.”

The Northern Powerhouse Investment Fund project is supported financially by the European Union using funding from the European Regional Development Fund (ERDF) as part of the European Structural and Investment Funds Growth Programme 2014-2020 and the European Investment Bank.

Maven Capital Partners UK LLP is authorised and regulated by the Financial Conduct Authority, Firm Reference Number 495929

If you would like to meet with one of NPIF's appointed Fund Managers to talk in more detail please go to Funds Available to find the Fund Managers operating in your area