5th September 2023

Tags

A Leeds-based solar energy firm has invested in stock and people following a £50,000 loan from Business Enterprise Fund (BEF) and NPIF – BEF & FFE Microfinance, which is managed by BEF and FFE Microfinance, and part of the Northern Powerhouse Investment Fund.

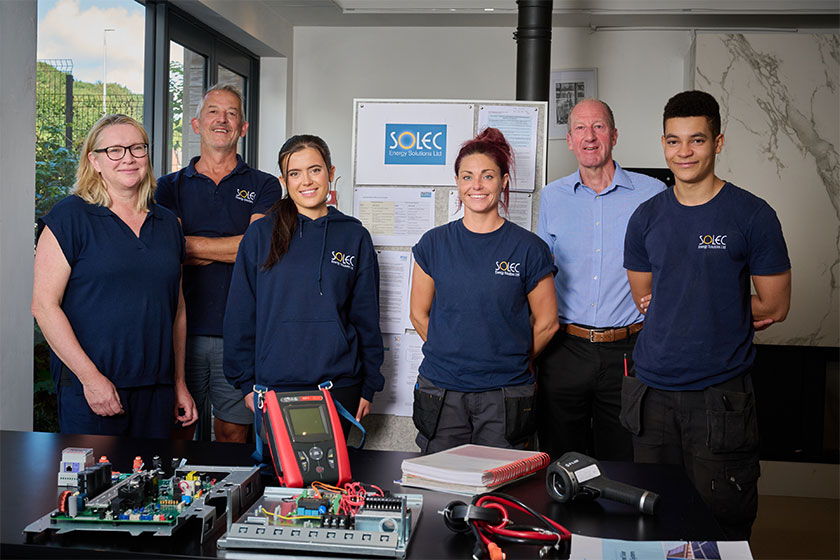

Solec Energy Solutions, owned by husband and wife team Robert and Gaye Wilmot, was established in Leeds in 2011. The company specialises in the design, supply and installation of renewable energy systems for homes and businesses. Founded by electrician Robert, the company provides solutions on Solar PV & Electrical Energy Storage Systems (EESS), Heat Pump installations, LED lighting and energy saving controls.

The loan, which has been used as working capital and staff investment, comes as consumers have a renewed focus on sustainability and after several years of disrupt to the industry.

Gaye Wilmot, sales and marketing director at Solec Energy Solutions, said: “When we first launched there was a steady uptake in renewable energy systems – Robert was amongst the first solar installers in Leeds with electrician credentials which gave people additional peace of mind when moving to a different energy source. At the time there was a range of subsidies available for both residential and commercial properties which meant business was booming.

As business interest in ESG (environmental, social and corporate governance) has increased in recent years, the market has certainly picked up but government support for the sector has been inconsistent; the Feed-in Tariff for Solar closed in 2019 and different schemes to encourage the switch to renewable heat have come and gone without addressing the skills shortage of young engineers needed to install the technology.

“Various global issues in recent years have also greatly impacted the supply chain. Thanks to the BEF NPIF loan our new offices, with a small warehouse space, have allowed us to start buying stock upfront, allowing us to be ready to install for customer’s orders rather than leaving them with a long waiting period. We’re a small, family business and pride ourselves on being agile to customer requirements – it’s crucial we have the stock to do so.”

As well as enabling Solec Energy Solutions to invest in stock, the loan has also helped the company create and safeguard jobs.

Robert Wilmot, said: “I trained as an apprentice electrician at the start of my career, so it’s always been important for me to create the same opportunities for people who want to join our industry. Thanks to the loan from BEF we’ve been able to take on a new apprentice to bolster the team. There are five of us in total now as well as a reliable group of sub-contractors meaning we’re well equipped in terms of both staff and stock to support our customers through their renewable energy journey.”

The team at BEF have provided wonderful support – we’ve truly felt like a name, rather than another impersonal number. We weren’t able to get approval for a bank loan due to the perception of renewable energy being high risk to investors and our variable profits, but thanks to BEF’s belief in us and our plans we’re able to grow our work with property developers, eco self-builders, community projects and businesses.”

Mark Iley, investment manager at BEF, said: “Robert and Gaye have a strong vision for Solec Energy Solutions, and with their renewable energy systems, they’re initiating a positive impact when it comes to ESG which we’re proud to support. As a family-run business they’re also creating job and training opportunities in the local area in an increasingly important industry, we’re looking forward to seeing the business go from strength to strength.

Debbie Sorby, Senior Investment Manager at British Business Bank, said: “Solec Energy Solutions is an excellent example of entrepreneurial innovation within the renewable energy sector. The business’ contributions to the reduction of carbon emissions and the promotion of sustainable energy solutions aligns with the increasing consumer demand for environmentally conscious products and services.

The NPIF investment has not only supported the company’s working capital needs and staff investments but has also empowered them to adapt to changing market dynamics, contributing towards a more sustainable future.

Beyond supporting Solec’s capacity to address the demand for renewable energy solutions, this loan has played a crucial role in job creation and retention within the Yorkshire region. By allowing the company to invest in stock and maintain a ready supply of products, the loan has not only improved the customer experience but also generated employment opportunities, supporting the local economy.

Solec Energy Solutions’ growth story serves as a testament to the potential of targeted financial support in fostering sustainable businesses and driving economic development within the Northern Powerhouse region.”

The Northern Powerhouse Investment Fund project (NPIF) is supported financially by the European Union using funding from the European Regional Development Fund (ERDF) as part of the European Structural and Investment Funds Growth Programme 2014-2020 and the European Investment Bank.

For further information about the Business Enterprise Fund, please visit www.befund.org.

If you would like to meet with one of our appointed Fund Managers to talk in more detail please go to 'Funds Available' to find the Fund Managers operating in your area

Just add your details below to receive the latest Northern Powerhouse Investment Fund news and information