Partner:Mercia Fund Managers

Region:Humber

Location:Hull

Programme:Northern Powerhouse Investment Fund

A Hull healthtech start-up which has developed an award-winning device to enhance mental wellbeing secured a £200,000 investment from NPIF-Mercia Equity Finance, which is managed by Mercia Fund Managers and is part of the Northern Powerhouse Investment Fund.

Moodbeam’s wearable device allows users to log their mood and monitor their emotional wellbeing – or that of their children, students, patients or employees. The device, which links to an online and mobile platform, gives insights into how moods change over time, showing patterns and trends that can support positive change. The funding will allow the business to put the device into production.

Moodbeam was founded in 2016 by the Gadget Shop founder and Red5 co-founder Jonathan Elvidge, and former journalist Christina Colmer McHugh, who came up with the idea after her daughter became anxious at school. The device won Best Emerging Technology at the 2017 Hull Digital Awards.

Over the past year, prototypes have been trialled in multiple settings and the company, which is based in Hull’s Centre for Digital Innovation (C4DI), has received interest from potential users including a university, the NHS, businesses, sports councils and health campaigners.

Christina said: “It’s been a two-year journey, but Moodbeam has been shown to provide valuable insights into wellbeing and mental health. We set out to create a device with the potential to change lives. This investment will help to make that possible.”

Simon Crabtree, Investment Manager with Mercia Fund Managers, said: “Moodbeam has proven to be a powerful offering, thanks to its ability to timestamp emotions and provide an ‘at a glance’ way to see how people feel. The technology could have a wide range of uses, from supporting children and young adults and the elderly in care, to enhancing wellbeing in the workplace and sports performance. The funding will allow the company to take the next step in bringing it to market.”

Mark Wilcockson, Senior Relationship Manager at British Business Bank, said:

“The Northern tech sector is giving rise to a number of exciting products, ideas, and innovations that are making a real impact on customers. Moodbeam is testament to that, and the company’s award-winning device has the potential to make positive differences to the wellbeing of customers. We are pleased to announce this latest round of funding from the Northern Powerhouse Investment Fund, and are confident that the team at Moodbeam will continue to build on its momentum as a result.”

John Connolly, Managing Director of C4DI, provided business, technology and fundraising advice to the company.

The Northern Powerhouse Investment Fund project is supported financially by the European Union using funding from the European Regional Development Fund (ERDF) as part of the European Structural and Investment Funds Growth Programme 2014-2020 and the European Investment Bank.

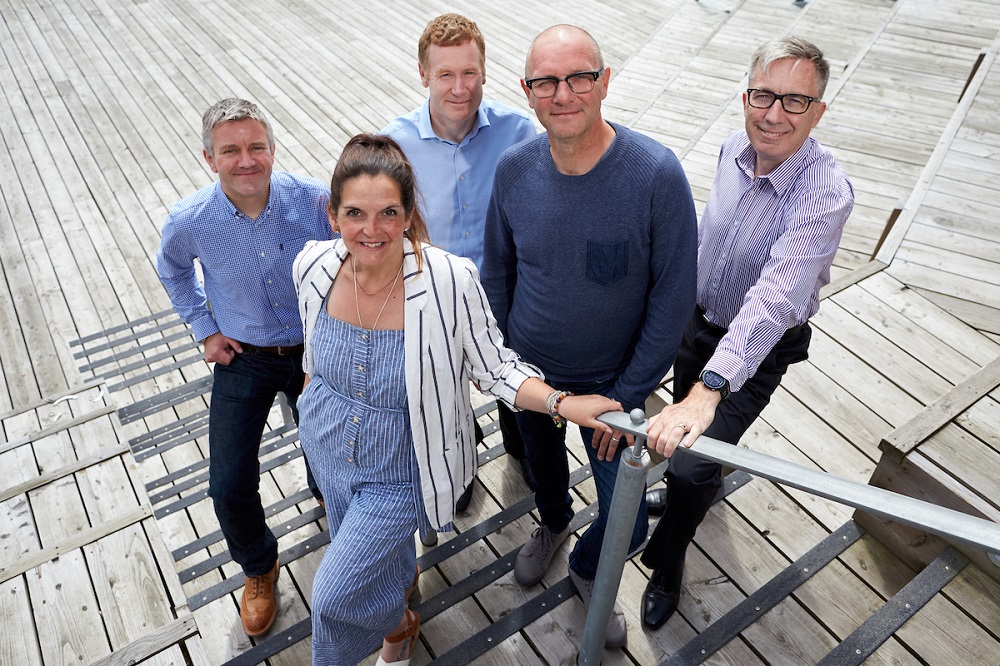

Photo Caption: John Connolly, Christina Colmer McHugh, Simon Crabtree, Jonathan Elvidge, Mark Wilcockson

Enterprise Ventures Limited is authorised and regulated by the Financial Conduct Authority (FRN: 183363)

If you would like to meet with one of NPIF's appointed Fund Managers to talk in more detail please go to Funds Available to find the Fund Managers operating in your area